By Joanna Puddister King

JACKSON – So many of us have large philanthropic hearts, but our wallets and budgets don’t allow us to make that large gift that is in our heart. The Catholic Foundation offers donors an opportunity to give a gift and receive income back called a Charitable Gift Annuity (CGA).

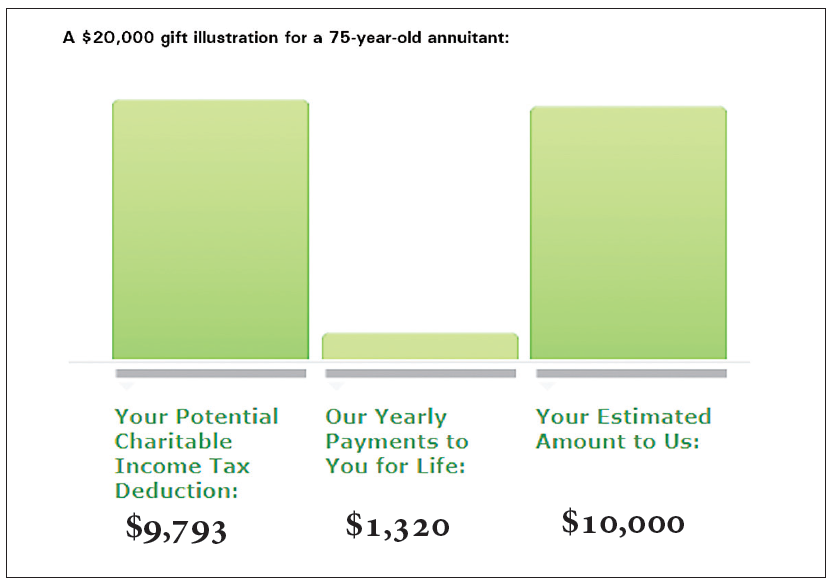

Charitable Gift Annuities (CGA) are gaining popularity due to the rising payout rates. “Now is a great time to consider establishing a CGA,” said Rebecca Harris, executive director of the Catholic Foundation. “A CGA is a simple arrangement where assets are given and in return the donor will receive fixed lifetime payments.”

Harris can help walk anyone interested in CGAs through the process. This is a way for a donor to give a gift now, receive income, and help their parish, school, or favorite Catholic ministry. The Catholic Foundation and the Diocese of Jackson are partnering with Catholic Extension to work with donors on establishing a CGA.

“Many donors shy away from these types of donations because they feel they are too complicated for them. Our goal is to walk you through the process to determine if this is the right type of gift for you,” says Harris.

A CGA is a simple contract guaranteeing it will pay the donor a fixed lifetime income based on a donor’s age and gift size that can be for one or two annuitants, and the payouts can be deferred. This is often a preferred strategy for retirees who want to put their charitable dollars to work and not have to worry about giving away a large sum of your retirement at once. “Simply, it is a way to support your Catholic faith and retain your cash flow,” says Harris.

The primary benefit of a CGA is that the donor receives a fixed payment for life, no matter how long he or she may live. A portion of the payments are tax-free for a specified time. Further, because the donor is making a gift, a portion of the amount paid for the annuity is an immediate deductible charitable gift for income tax purposes, as allowable by IRS rules.

Harris says, funding a CGA can be done with cash, IRA required minimum distribution, and stocks and securities.

“If you are looking for a way to decrease your income tax obligation after retirement and support your Catholic faith, a CGA may be what you are looking for,” says Harris.

To receive a free illustration of your gift contact Rebecca Harris at (601) 960-8477. With a few details her office can provide you with a gift illustration. Included in the illustration is your potential charitable income tax deduction and your yearly payments for life as well as an estimated amount that will go to your beneficiary.