By Rebecca Harris

JACKSON – The Catholic Foundation works to help with your philanthropic goals. Part of our mission is to foster stewardship here in our diocese the Catholic Foundation works with individuals who are interested in starting a charitable gift annuity. Many donors shy away from these types of donations because they feel they are too complicated for them. Our goal is to walk you through the process to determine if this is the right type of gift for you.

What is a Charitable Gift Annuity?

It is is an arrangement that permits a donor to make a gift to while retaining a stream of fixed income payments for the donor’s life. Any balance remaining in the annuity after the death of the donor then passes to the Foundation for the ministry, parish, or Catholic School chosen by the donor.

What are the Benefits?

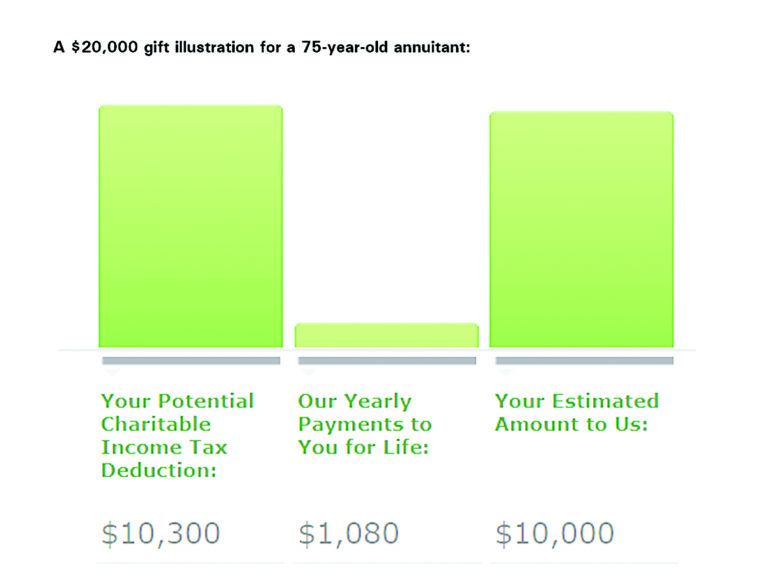

The primary benefit of a Charitable Gift Annuity is that the donor receives a fixed payment for life, no matter how long he or she may live. A portion of the payments are tax-free for a specified time. Further, because the donor is making a gift to the Catholic Foundation, a portion of the amount paid for the annuity is an immediate deductible charitable gift for income tax purposes, as allowable by IRS rules.

The donor would also have the satisfaction of knowing that a gift today will be used to support future Catholics in our diocese.

What are the Features?

The donor receives secure convenient deposits of payments into your preferred bank account. There are three types of annuities to select from immediate one life, immediate two lives, or deferred payments to start later. The minimum amount to establish a charitable gift annuity is $5,000 and the minimum age to receive income is 55 years old.

Is a Charitable Gift Annuity right for you?

Our staff is ready to work with you. To get a free illustration of your gift please contact Rebecca Harris at (601) 960-8477. With a few details and we can provide you with a gift illustration. Included in the illustration is your potential charitable income tax deduction and your yearly payments for life as well as an estimated amount that will go to your beneficiary.